Bringing a great preapproved to own a home loan are a vital first move at your home to purchase techniques. That it original action not just helps you know your allowance however, together with allows you to a very glamorous buyer to help you sellers. The following is a thorough guide on precisely how to have one inside 5 steps:

1. Gather Related Files

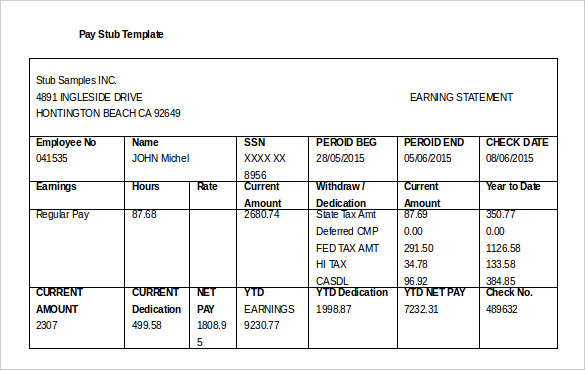

Beforehand brand new preapproval techniques, assemble extremely important monetary papers. Most loan providers generally speaking wanted evidence of terrible monthly earnings (such as for instance shell out stubs), employment record, taxation returns, credit score, and you can details about your assets and you may month-to-month loans money (including car and truck loans, financial comments, or other monthly payments). That have this type of records planned and you can in a position will streamline the application form processes, therefore it is reduced and much more effective.

2. Rating Pre-recognized (Sure, today!)

Once your documentation is within acquisition, feel free-score preapproved to have a mortgage. Of several homeowners make the mistake regarding domestic browse before securing an effective preapproval letter, resulted in frustration and you will lost go out. In just minutes on the home loan pre acceptance techniques now, can save you days later in the purchasing processes. A great pre-recognition brings a definite image of our home loan amount you be eligible for, allowing you to notice your pursuit on the properties affordable.

3. Get a credit rating Consider

Your credit score plays a pivotal part in the choosing the interest rates and you can regards to the mortgage. Ahead of looking to pre-acceptance, receive a credit report to assess your score. Should your score demands improve, do something to compliment they before applying. A top credit history just expands the acceptance and enhances the regards to their home loan.

cuatro. Keep Home loan Pre-Acceptance Page Convenient

After you’ve gotten the pre-recognition page, address it particularly a wonderful admission. Their mortgage preapproval page are a formal document on the financial claiming maximum amount borrowed your be eligible for. Ensure that is stays convenient during your household search, whilst demonstrates your own severity as the a buyer and you will improves your settlement status having suppliers.

5. Know how Much time Pre Acceptance Lasts

Home loan preapprovals possess a shelf-lifestyle. Understand the termination date on your own pre-acceptance page. Normally, pre-approvals is actually good to have 60-ninety days, but this can are very different one of loan providers. If your household lookup runs past this era, speak to your bank having an extension. Keeping your pre-approval most recent means that youre nevertheless eligible for the new first accepted loan amount.

What is actually Home financing Pre-recognition?

A great pre-acceptance is actually a first analysis because of the a loan provider one to determines the fresh number these are typically willing to lend you having a house get. This course of action involves a thorough report about the money you owe, together with your income, credit score, possessions, and you may expenses. The financial institution evaluates this short article to choose the restrict number you qualify for, the possibility mortgages on the market, additionally the applicable rates of interest.

Financial Pre-recognition Compared to. Prequalification

Both mortgage prequalification and preapproval suffice the intention of estimating the fresh new amount borrowed you could potentially qualify for. not, it differ somewhat regarding breadth and you will accuracy:

Financial pre-qualification try an informal investigations by a loan provider, depending on the fresh new financial information you offer. It offers a quotation off how much cash you happen to be ready so you can borrow. not, it is really not due to the fact thorough just like the good pre-recognition because cannot involve an in-depth research of your credit history otherwise verification of one’s economic data files.

Pre-recognition, concurrently, is actually a very powerful analysis. Lenders scrutinize your financial information as well as credit guidance, income, possessions, and you will month-to-month debts, so you’re able to procedure good conditional relationship having a certain home mortgage number. A great pre-approval keeps more excess body fat regarding eyes away from suppliers because it suggests a sophisticated off relationship and believe on the function to help you safer investment.