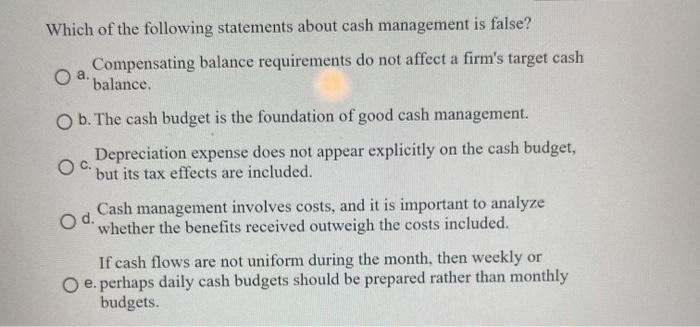

Getting into your way for the homeownership is a big milestone, and securing a conventional financing is a switch part of which process. Instead of regulators-recognized finance, antique finance feature a more strict approval procedure while they lack regulators insurance rates otherwise pledges. To help you inside navigating so it detail by detail process seamlessly, we now have very carefully crafted one step-by-step list describing the absolute most conventional mortgage criteria.

Learn Your credit rating

Opening the typical application for the loan necessitates a thorough comprehension of their credit score. Your credit score was a mathematical representation of one’s creditworthiness, highlighting your financial history and you can activities. Lenders leverage that it score to test the danger of lending to you personally to discover the interest rate for the mortgage. A top credit score will usually means a whole lot more advantageous traditional loan conditions, as well as lower rates and you will potentially lower down fee standards.

If you’re the very least credit score regarding 620 can be expected to be eligible for a conventional mortgage, it is necessary to keep in mind that higher fico scores may cause in addition to this costs and a lot more favorable loan conditions. Thus, ahead of diving into conventional loan application techniques, take the time to remark your credit history, choose any potential circumstances, and you can focus on boosting your get if necessary.

Collect Economic Records

Lenders take on a meticulous examination of debt history to evaluate your ability to settle the borrowed funds. This calls for getting some documents offering a comprehensive view of your debts:

Taxation statements: Anticipate to give the last 2 yrs of your own federal earnings tax statements. This provides you with lenders with insight into your income balances and you can one prospective sources of additional money.

Pay Stubs: Bringing current pay stubs is vital since it functions as real evidence of the secure earnings. It paperwork facilitate lenders make sure their a career condition and you will assess your capacity to create fast home loan repayments.

Bank Comments: Lenders scrutinize discounts and bank account comments to test debt balances. This can include evaluating what you can do to handle present debts and you may expenditures.

A position Confirmation : Expect you’ll verify your a position background and newest a career status. Loan providers can get contact your workplace to confirm your task balance and you may income.

Assess Your debt-to-Money Proportion

Loan providers closely test your personal debt-to-money ratio (DTI) to be certain you can take control of your monthly home loan repayments without monetary filter systems. The newest DTI is actually computed by breaking up their month-to-month debt costs by the disgusting monthly income. Try for a DTI lower than 43% to enhance your antique loan recognition prospects. That it demonstrates to lenders which you have adequate income to pay for one another your current expenses in addition to suggested mortgage repayment.

Save to have a deposit

If you’re antique money fundamentally want a smaller sized downpayment compared to some government-recognized funds, having a substantial downpayment can undoubtedly determine the loan terminology. Preserving ranging from 5% so you can 20% of residence’s price is advisable so you’re able to safe a traditional financing. A more impressive deposit besides reduces the amount borrowed but in addition to shows financial obligation and dedication to the newest investment.

Like a professional Lender

The selection of the right lender was pivotal to a successful application for the loan. Perform thorough research for the various loan providers, compare rates, charges, and you will conditions, and read customer evaluations to ensure the picked institution aligns with your financial demands. Think affairs particularly customer support, responsiveness, in addition to lender’s reputation in the market.

Score Pre-Recognized

In advance of embarking on domestic bing search, acquiring pre-approval getting a normal loan is very important. Pre-recognition pertains to a thorough breakdown of your financial recommendations from the bank, ultimately causing a beneficial conditional union having a particular antique loan amount. This process offers a clear understanding of your financial allowance, allowing you to work at properties in your economic come to and you may making the domestic-to purchase process better.

Domestic Assessment

Up on pinpointing a prospective possessions, the lending company performs a conventional mortgage appraisal to determine the market value. This new assessment is a must to possess making certain that the property’s really worth aligns towards the conventional amount borrowed. Oftentimes, deals can be requisite based on the appraisal performance. This action facilitate protect the buyer and also the lender by the making sure the house try an audio funding.

Finally Mortgage Recognition

After the Antique Financial appraisal, the lending company conducts a last report about https://paydayloancolorado.net/san-acacio/ your application. This may is even more paperwork and a final credit assessment. If the everything suits their requirements, you’ll receive finally traditional mortgage approval. This task scratches the culmination of your software techniques, and you are today prepared to stick to the closure processes and take control of one’s new house.

Achievement

Effortlessly navigating the typical application for the loan techniques means careful planning and you may attention to outline. By the adhering to this full step-by-action list, you could potentially rather increase likelihood of protecting a traditional mortgage and you will realizing your dream out-of homeownership. Make sure to seek information away from a monetary advisor or mortgage professional having customized guidance customized to your particular condition. Homeownership is a big achievement, along with the right studies and you can preparing, you could with certainty grab so it extremely important step up your financial journey.