She listened to my inquiries and you can told me exactly what documents I should require, especially when We told her I happened to be convinced the loan had started sliced and you may sold of because a mortgage-backed coverage. Ms. Collier mentioned that Pursue could have twenty (20) working days to respond and i should name their particular to check out-up. We said in the event the Pursue answered inside twenty working days it could end up being a primary! It had not responded to my personal OCC ailment that was more than sixty days old, nor had it responded to my personal page to David Lowman Chase Domestic Credit President.

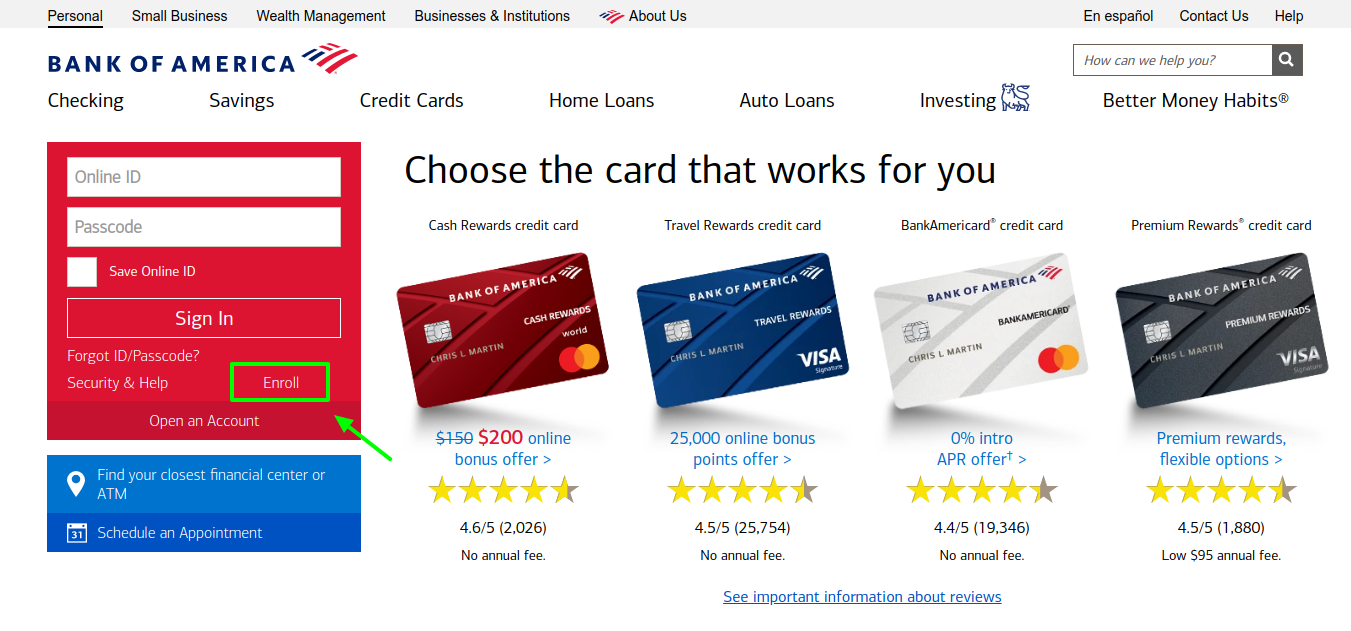

WaMu Pursue Contact info

Arizona Common mortgage customers are serviced by Chase. Within the https://speedycashloan.net/loans/furniture-loans/ later , the latest FDIC offered Washington Mutual’s possessions, covered debt obligations and you can deposits in order to JPMorgan Chase & Co. Home loans and this started that have Washington Mutual and so are inside the standard end up with Chase House Fund within the Ca; you’ll be able to (unverified) that Washington Mutual began money try addressed inside the Ca of the Chase Home Funds. Following is a summary of key Arizona Shared Chase contacts having phone numbers and/otherwise websites when available:

You cannot do so alone. Get a great HUD-acknowledged therapist in order to negotiate for you. He or she is Free. Head to Springboard (800) 431-8456 to possess Nonprofit Consumer credit Management or check out:

Just click while having come. Chase states they wish to help but they are providing lip services simply to the newest Western someone. Your own taxation bucks keeps covered HUD-accepted counseling, put it to use!

Why fool around with a therapist? Since when your submit the brand new models, Pursue are running your wide variety facing a great black container formula only they are aware. Your own specialist can also be no less than tell you in the event the wide variety try way out of range and go beyond national averages. You should use the tool on the arsenal to battle the newest Pursue servers and then have financing amendment.

Try to fill in a third-group agreement function so that a counselor to speak on your own part that have Pursue. Request the design off both Chase to discover if your own HUD-accepted specialist possess a questionnaire. Fill in one another instantaneously very Pursue are unable to appears.

HAMP & $729,750…this is the dollars limit on the loan balance that will be changed from the HAMP, however the number try mistaken. A buck cap is assigned to for each and every condition in the nation. Such as for example, into the Cape P limit try $487,five-hundred. Since the my personal mortgage harmony try higher than $487,500, (while having has been greater than $729, 750) I don’t be eligible for good HAMP modification. I be considered just for a champ (Pursue inside-domestic program) amendment. Save time and you will problems and you can see your county HAMP cap in order to know if your also be eligible for an excellent HAMP modification!

: We returned and you may ahead from the elizabeth-mail right through the day to the Wall surface Path Record reporter, responding questions relating to my financial situation, why I found myself however wishing, why We had not simply sold my house, etcetera. At the end of the day new reporter explained he would simply asked Pursue as to why I had not obtained a reply immediately following nearly fifteen weeks. I was surprised.

We mutual my personal suspicions one to maybe this was as to why I became cannot get loan modification answers from Pursue

Would it take the Wall Path Log to acquire an answer regarding Pursue on the my personal loan mod? That was crazy! Why failed to anyone else rating upright answers of Pursue?

It seemed to myself you to definitely Pursue is actually continuing this new inaccurate techniques began by the Arizona Shared. I wasn’t alone just who thought that way; Treasury Assistant Timothy Geithner vowed to compromise upon shoddy means…possibly I ought to make your a page too.